The Markets Are Monitoring the Movements of Central Banks This Week.

Market News Summary

European stock indices rose at the end of Friday’s trading session as investors evaluated key employment data released in the United States. The European Stoxx 600 index closed up 0.7%, with travel and entertainment stocks rising by 1.5% to lead the gains, while mining stocks fell by 2.3%.

Major central banks are expected to keep interest rates unchanged this week amid renewed concerns about rising inflation rates. There is a parallel concern with increasing expectations of sharp interest rate cuts next year.

Dollar Index (USDX)

The markets are awaiting a decisive week, marked by the final interest rate decisions of the year from the U.S. Federal Reserve, the Bank of England, and the European Central Bank. It is expected that they will maintain interest rates at their current elevated levels as part of the monetary tightening policies implemented since last year to ensure that inflation continues to decline from its decades-high levels, eventually reaching the targeted rates.

The U.S. Federal Reserve holds its final meeting of 2023 on December 12 and 13. Meanwhile, the Bank of England and the European Central Bank will hold their meetings on Thursday, December 14.

Pivot point: 103.85

| Resistance level | Support level |

| 104.35 | 103.50 |

| 104.70 | 103.00 |

| 105.20 | 102.60 |

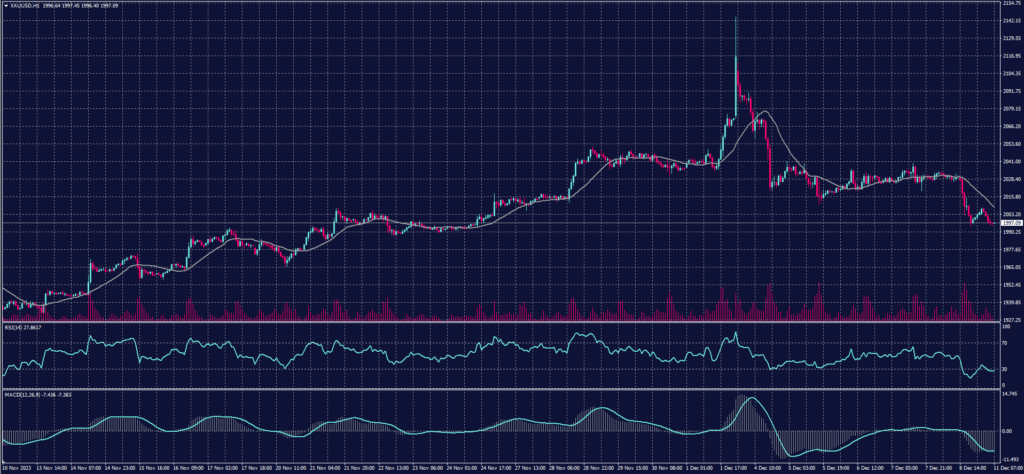

Spot Gold (XAUUSD)

Gold prices declined at the end of Friday’s trading session following the release of U.S. employment data, which showed better-than-expected results. This led to an increase in Treasury bond yields and the U.S. dollar.

Gold prices fell by 1.6% or approximately $31.90 to settle at $2014.50 per ounce. This closing price is the lowest since November 27, and on a weekly basis, U.S. gold futures recorded a 3.7% loss, marking the first decline since the week ending on November 10.

Pivot point: 2010

| Resistance level | Support level |

| 2027 | 1987 |

| 2050 | 1971 |

| 2066 | 1948 |

Dow Jones Index (DJ30ft – US30)

The futures contracts for U.S. stocks opened the week relatively stable as investors awaited the final meeting of 2023 for the Federal Reserve. During this meeting, investors hope to receive any signals about the timing when central bank policymakers might begin cutting interest rates.

Futures contracts linked to the Dow Jones Industrial Average added seven points or 0.02%. Meanwhile, futures contracts for the S&P 500 declined by 0.01%, and futures for the Nasdaq 100 dropped by 0.08%.

Pivot point: 36210

| Resistance level | Support level |

| 36405 | 36085 |

| 36530 | 35885 |

| 36725 | 35765 |

US Crude Oil (USOUSD)

On Monday, December 11th, oil prices continued their gains for a second session as the United States sought to replenish its strategic reserves, providing some support. This occurred despite ongoing concerns about an oversupply of crude and weak fuel demand growth in the coming year.

Prices rose to around $75.95 per barrel, and futures for West Texas Intermediate (WTI) crude increased to $71.30 per barrel.

Pivot point: 70.75

| Resistance level | Support level |

| 72.05 | 69.90 |

| 72.85 | 68.65 |

| 74.15 | 67.80 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.